How does Growth Investing Differ from Value Investing?

When it comes to investing in stocks, two popular strategies often come up—growth investing and value investing. They each focus on different types of companies and have their own pros, cons, and ideal conditions.

Let’s break down what each one means in simple terms and help you figure out which style might work better for you.

What is Growth Investing?

Growth investing is all about betting on companies that are expected to grow faster than others. These companies are usually in sectors like technology or communication, and they focus on increasing their revenue, profits, or cash flow rapidly.

Instead of paying regular dividends, they often reinvest their profits into growing the business. That’s why their stock prices are usually higher—and sometimes, riskier.

A simple example:

You might buy a stock at ₹500 because you believe it could go up to ₹1,000 in a few years. These companies are typically young, innovative, and not afraid to spend big to grow fast.

Famous growth investors include Thomas Rowe Price Jr. and Philip Fisher, who focused on companies with long-term expansion potential.

Also Read: How to Build an Emergency Fund Effectively?

What is Value Investing?

Value investing is more about finding solid companies that are currently undervalued. These businesses may be older, more established, and often found in sectors like finance or energy. Value investors look for companies that are trading for less than what they’re truly worth.

These companies usually pay regular dividends, have low debt, and offer steady growth. Think of it this way: you’re buying a stock worth ₹500, but it’s currently selling for ₹50.

Legendary investors like Warren Buffett, Benjamin Graham, and Charlie Munger follow this approach.

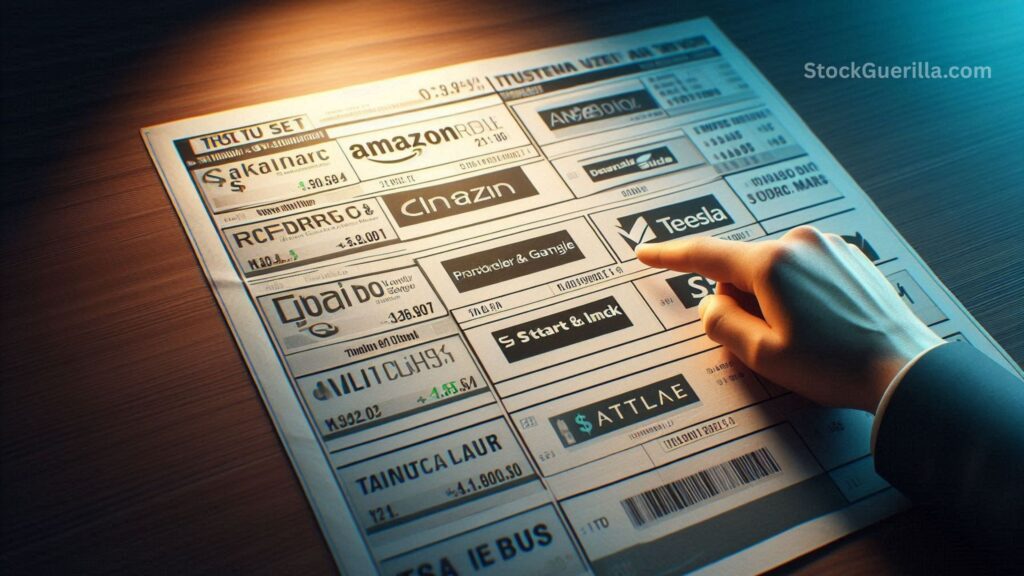

Comparing the Two: Growth vs. Value

| Feature | Growth Investing | Value Investing |

|---|---|---|

| Main goal | Capital appreciation | Capital preservation |

| Target companies | Fast-growing, innovative firms | Undervalued, stable companies |

| Stock price | Usually high | Often low |

| Volatility | High | Lower |

| Dividends | Rare or none | Regular and steady |

| P/E Ratio | High | Low |

| Risk level | Higher | Lower to moderate |

| Examples (India) | Zomato, Bajaj Finance | SBI, Coal India |

| Examples (US) | Amazon, Tesla | Procter & Gamble, JPMorgan Chase |

| Best market condition | Bull markets | Bear markets or uncertain times |

When Does Each Strategy Work Best?

- Growth stocks tend to perform well during bull markets or periods of economic expansion, especially when interest rates are low.

- Value stocks shine during recessions or when markets are down, as investors look for safer and more reliable options.

Also Read: What is an IPO and How can you Invest in one?

Real-World Examples

Growth Stocks:

These are companies still in their fast-growing phase—think Zomato, Reliance, Amazon, or Netflix. They may not have been through multiple market cycles yet, but they have a competitive edge in tech or innovation.

Value Stocks:

These are companies that have weathered all kinds of economic ups and downs. They usually sell essentials or provide necessary services. Examples include Power Grid Corporation, Coal India, or State Bank of India. In the US, you have names like Procter & Gamble or JPMorgan Chase.

Which One is Better?

Honestly, there’s no one-size-fits-all answer.

- Choose growth investing if you’re comfortable with risk and want higher returns in the long run. But remember, these companies might not pay dividends and can be more volatile.

- Go for value investing if you prefer steady returns, dividends, and lower risk. This strategy requires patience and a good eye for hidden gems.

Also Read: What are the Top Passive Income Ideas for 2025?

What’s Happening Now?

Lately, growth stocks have been more popular—especially with all the changes brought on by COVID-19 and shifts in consumer behavior. Tech companies, in particular, have thrived.

But history shows that value stocks tend to outperform over the long term, especially across multiple market cycles. If inflation rises or interest rates climb, value stocks may become more attractive again.

Final Thoughts

Both styles have their place in a smart investment strategy. You don’t always have to choose just one—many investors create a balanced portfolio that includes both growth and value stocks.

Whether you prefer riding the wave with fast-moving growth companies or finding hidden treasures with value stocks, the key is to understand your risk appetite, goals, and the market conditions around you.

Post Comment